Financing is an important factor in the stability of the housing market. At the luxury end of the market you are talking about big loans with significant risk to the investor.

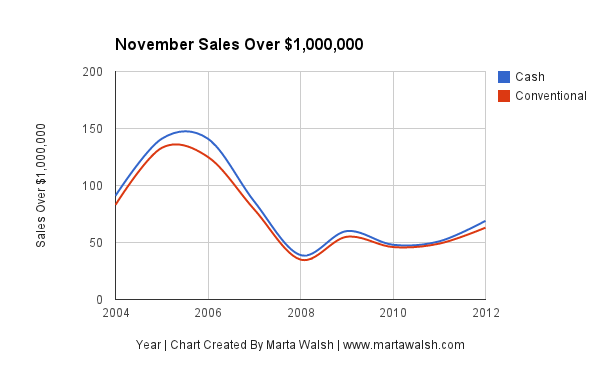

I decided to take a look sales on a year by year basis to see how the balance of cash vs. conventional financing was looking. My thoughts before running the numbers were that there would be significantly higher percentage of conventional loans than cash deals as the market rebounded. This assumption was wrong. Take a look at the chart below.

As you can see the two lines are very close with no significant divergence at any point on the chart.

What Does This Tell Us?

Well in the luxury market of homes sold at a price of $1 million or more there is an almost even balance of cash deals to those closed with conventional financing.

Both cash and financed deals rise and fall with the general health of the market.

This makes sense because at the heart of all transactions is an investor. In a cash transaction the buyer is their own investor. There no reason to believe that when institutional money is staying out of the market that private individuals wouldn’t also be of the same mind.

So the chart really just confirms that cash and financed purchases have bounced off the bottom in 2008 and maintain close to 50% of all deals each.