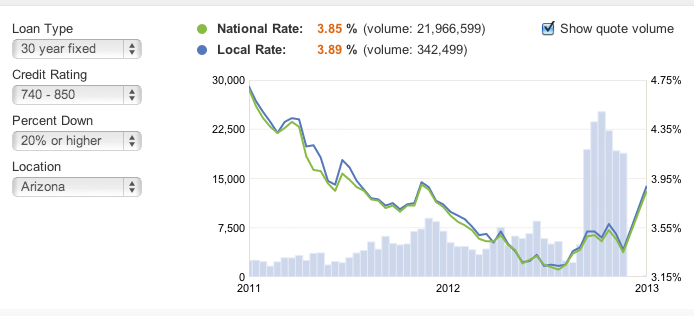

The Arizona mortgage interest rate on June 5, 2013, is up 64 basis points from last week’s average Arizona rate of 3.36%.

Ok that’s something we haven’t seen in the market for a while. The thought that mortgage rates are going to start going back up. But it looks like something the market will need to get used to rising rates.

That’s a big rise. In a week. And it took experts somewhat by surprise.

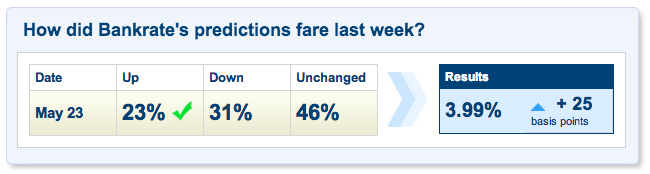

Here’s how the www.bankrate.com experts faired.

It seems the majority were caught by surprise.

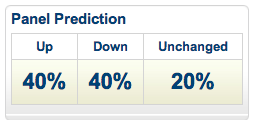

Here’s the prediction for this week.

Fairly unanimous agreement that no one knows what direction rates are moving. But I think if you take the period from one week to five years there would be almost 100% agreement that rates are going to head up.

Will This Hurt The Housing Market?

Or as the Washington Post asks “Will higher mortgage rates kill the housing market?“

From the article.

At a 30-year fixed-rate mortgage rate of about 3.8 percent, the typical American homebuyer can afford a $279,000 house. That’s 45 percent more than the current price of houses. That suggests that affordability isn’t the thing holding Americans back from buying houses (instead, it may be such factors as tight credit standards, difficulty building up a down payment or lack of confidence in future job prospects). It also implies that slight increases in the mortgage rate shouldn’t completely undermine the improvement in the housing market; the thing to watch is not rates per se, but what happens on those other factors that are drags on would-be homeowners.

Marta’s Thoughts

Real estate will always be as much controlled by local factors as national macro trends. Our market has been on a wild ride over the past 12 months. Here’s some of the factors we should consider in our market.

Short term

This bump in rates might be a bigger motivator for buyers than it is deterrent. The fear that rates will rise further out weighs the disappointment that they can’t find 30 years fixed at 3.6%. Inventory is still low in almost every part of the market so demand doesn’t need to be that strong to keep prices rising.

Rent vs. Own

People need to live somewhere. Buy or rent. All things being equal more people prefer to buy than rent for a whole mix of reasons if presented the two options at the same price. The risk would be if renting became ‘cheaper’ than buying.

Right now in Scottsdale, 85258 there are only 8 three bedroom homes over 2,000 square feet for rent at less than $3,000 a month. You can buy more house than you can rent for the equivalent monthly amount. As long as that remains true prices should stay stable.

Refi Wave May Be Over

Demand for refinancing was hit hardest by the acceleration in rates, with applications slumping 15.0 percent. The refinance share of total mortgage activity fell to its lowest level since July 2011 at 68 percent of applications from 71 percent the week before.

The gauge of loan requests for home purchases – a leading indicator of home sales – held up relatively better, falling just 1.6 percent.

Source: Reuters

So demand among buyers for a new loan stayed strong dropping on 1.6%. But refi’s are almost done.

Many people in existing homes had taken the recent rise in house prices to refinance loans from a few years earlier. Now that is going to be less cost effective I feel it may make people consider a move instead. That may sound far fetched but the reasoning would be as follows, people who want to lower monthly expenses would have to downsize to achieve that. Increasing both the number of sellers and buyers and increasing market volume and speed.

Conclusion

Don’t panic. But this is a significant change. The market may finally be moving out of the distress / recovery cycle and into a more ‘normal’ phase.

If I was planning to buy I would probably choose to lock my rate while we are still in the region of 4.0%. That means finding a place to buy sooner rather than later. Because the upside risk of rates dropping back down is far out weighed by the downside risk of rates continuing to climb.

If I was a seller I would view this as much less relavent news. The effects will be more medium to longer term in nature. Personally I don’t see it creating downward price pressure this year, especially if inventory remains low.