There are a lot of people undecided about whether to move from renting to owning right now. Asking themselves the classic question: Is Now a good time to buy a home? Here in Scottsdale the question is sometimes asked even more nervously simply because of the massive swing in prices we have seen locally.

Almost always when I discuss the buying decision with clients their focus is on the housing market. While the housing market is important it’s very important to also remember the financing side of a transaction. Unless you are bringing all cash to the close the mortgage rate you are paying will be as important as the price you are paying for the house.

To illustrate the point lets picture a family of four buying a 4 bedroom house in sunny North Scottsdale. Current asking price is $500,000. Lucky for them they have 20% to put down, so they will need a loan of $400,000. To estimate payments I used this mortgage calculator.

Here’s the results with an interest rate of 4.5% assumed.

Monthly Payment: 2,547.57

Total Interest Paid: 329,626.85

Now let’s assume they decide not to buy this house because they think the market is going to fall a little more in Scottsdale. Lucky for them they are right and 6 months later prices have fallen an additional 5%, the $500,000 home is now only $475,000 . They still want to put 100,000 down so now their mortgage amount is only 375,000. Unfortunately for them interest rates have risen to 5.5% during the time while they waited for the market to fall.

Here’s the result of waiting for the market to fall.

Monthly Payment: $2,624.00

Total Interest Paid: $391,515.15

Although the family saved $25,000 in purchase price by waiting for the market to fall the rise in interest rate lead to $61,888.30 in interest payments over the course of the loan.

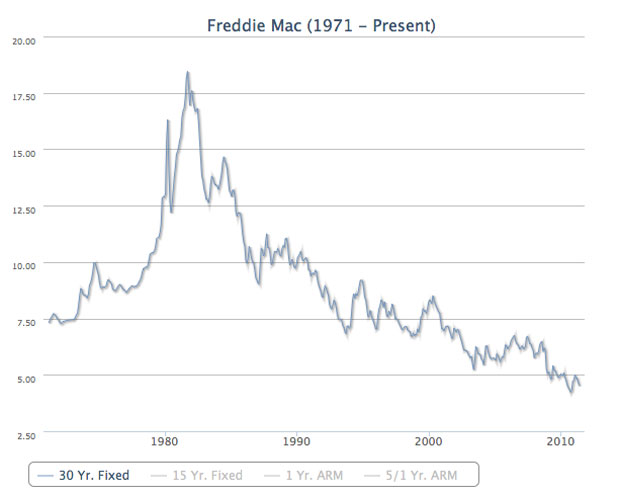

My point here is certainly not to advise whether the market will rise of fall or if interests will either rise or fall either in the short, medium or longer term. Merely to show how the interest rate can be as or more important than the direction of house prices in deciding when to buy. I think it is safe to say mortgage rates historically speaking are very low and the risk of rates rising may be more significant than the risk of property prices falling again.

PS. One way to keep up with the latest mortgage and interest news is to follow @FreddieMac on twitter.